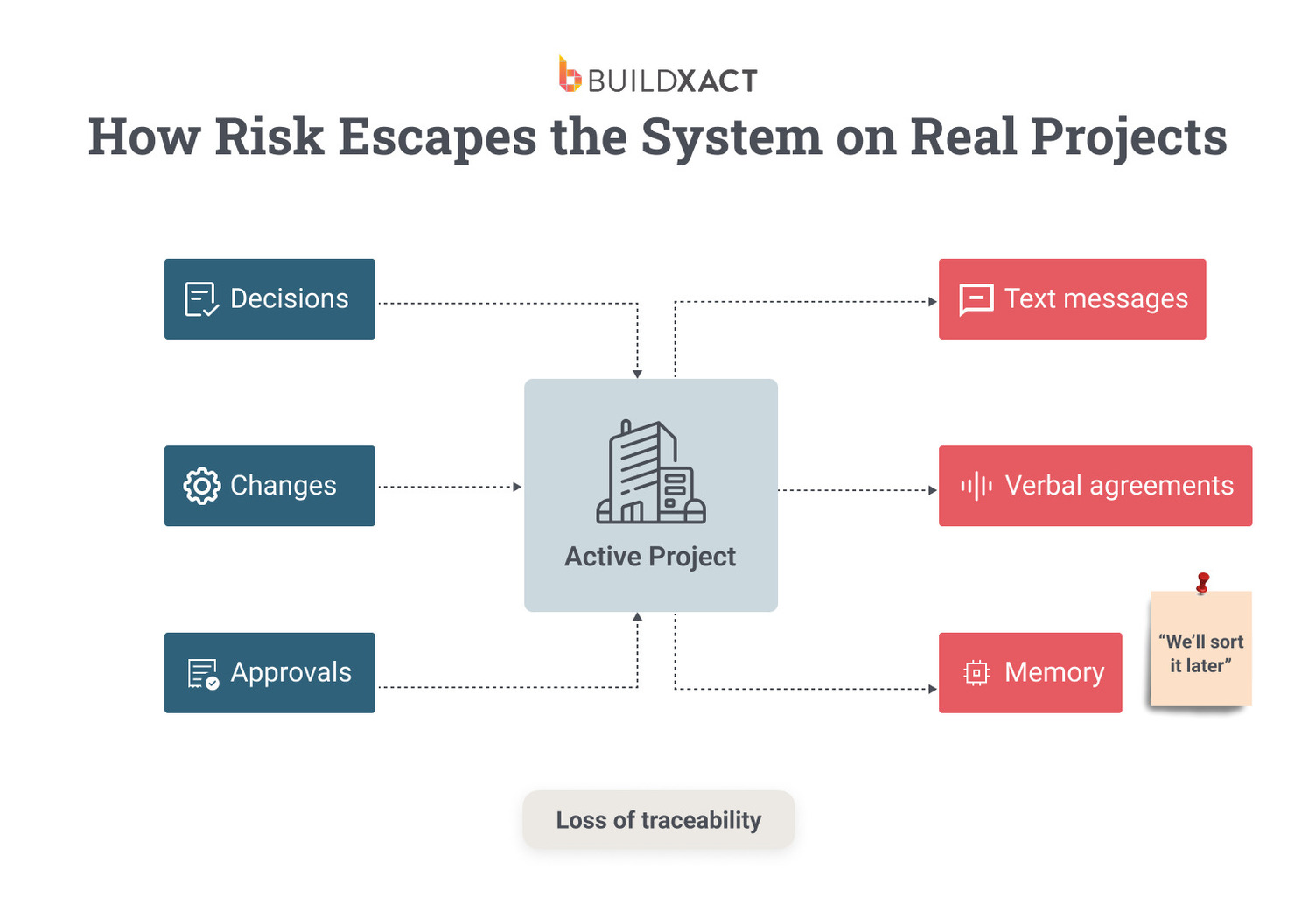

Most risk exposure enters the job through ordinary decisions you make to keep things moving: a change approved on site, a material swap agreed to over text, a schedule adjustment handled in conversation.

Each one made sense at the time, but you didn’t capture it, so those decisions never became part of a durable record tied to cost and scope.

By the time you ask questions, the context is gone. What changed, who approved it, and when it became expensive to undo are no longer clear. That’s why construction risk tends to make sense only in hindsight.

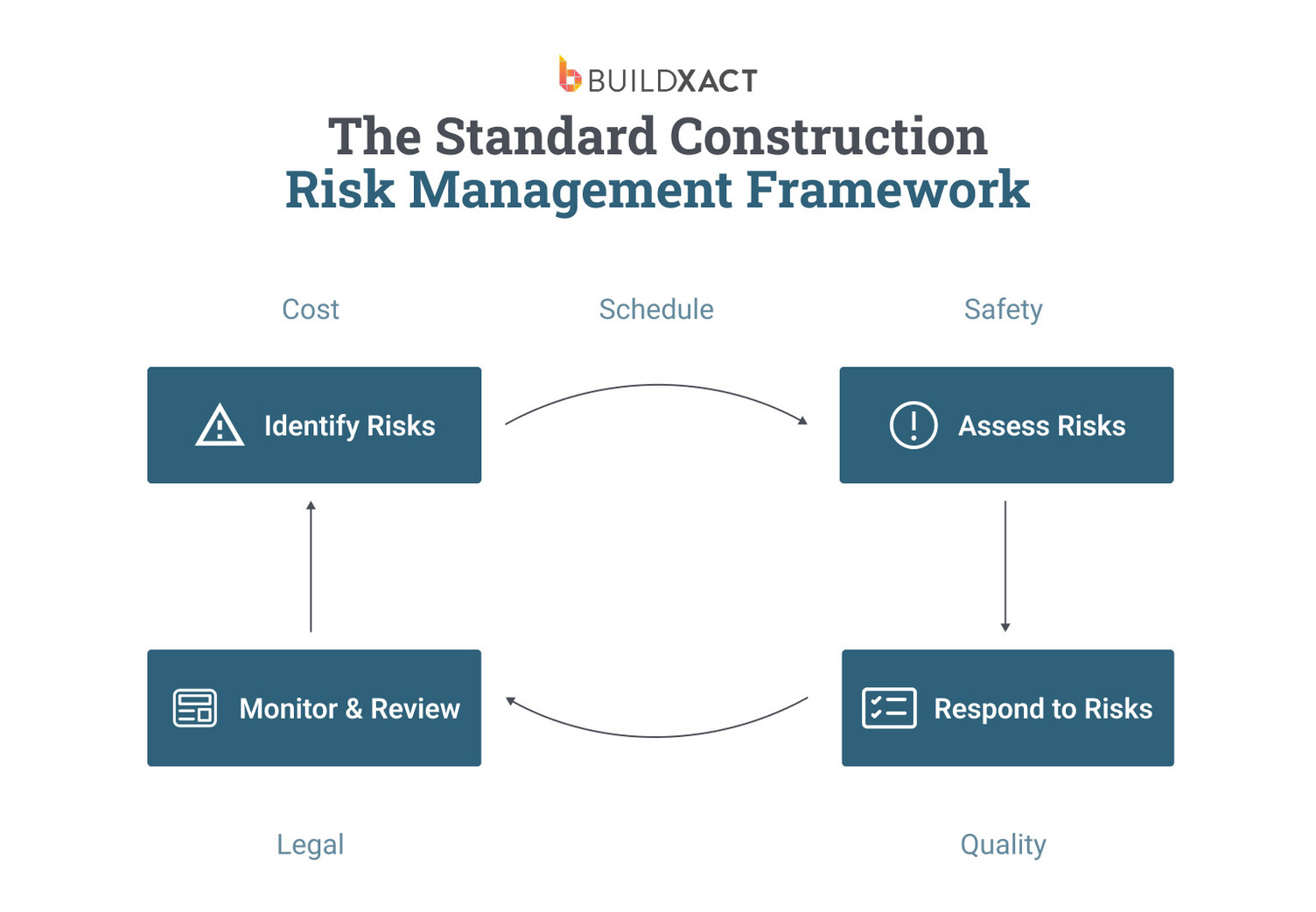

This guide uses the standard construction risk management framework to show where gaps on residential jobs could pose a risk, or, by making them easier to spot and fix early, stop being issues at all.

What Is Construction Risk Management?

Construction risk management is the process of identifying, assessing, responding to, and monitoring risks that could affect a project’s cost, schedule, safety, quality, or legal standing.

On paper, the process is straightforward. You list the risks, consider their impact, plan your responses, and put controls in place to monitor them over the life of the job.

For residential builders, the real test of that process is whether it answers a simple question:

Can you point to the decision that introduced the risk when costs or scope are questioned later?

On residential projects, risks don’t announce themselves — and they either remain hidden or don’t look like “risks” at all. But that doesn’t mean they aren’t common or familiar, often occurring during routine events like:

- Adjusting the scope to keep work moving.

- Failing to capture price changes between the estimate and order.

- Informal, verbal approvals rather than documented changes agreed on in writing.

At that point, the issue is whether you captured those decisions in a way that ties them back to cost, timing, and responsibility.

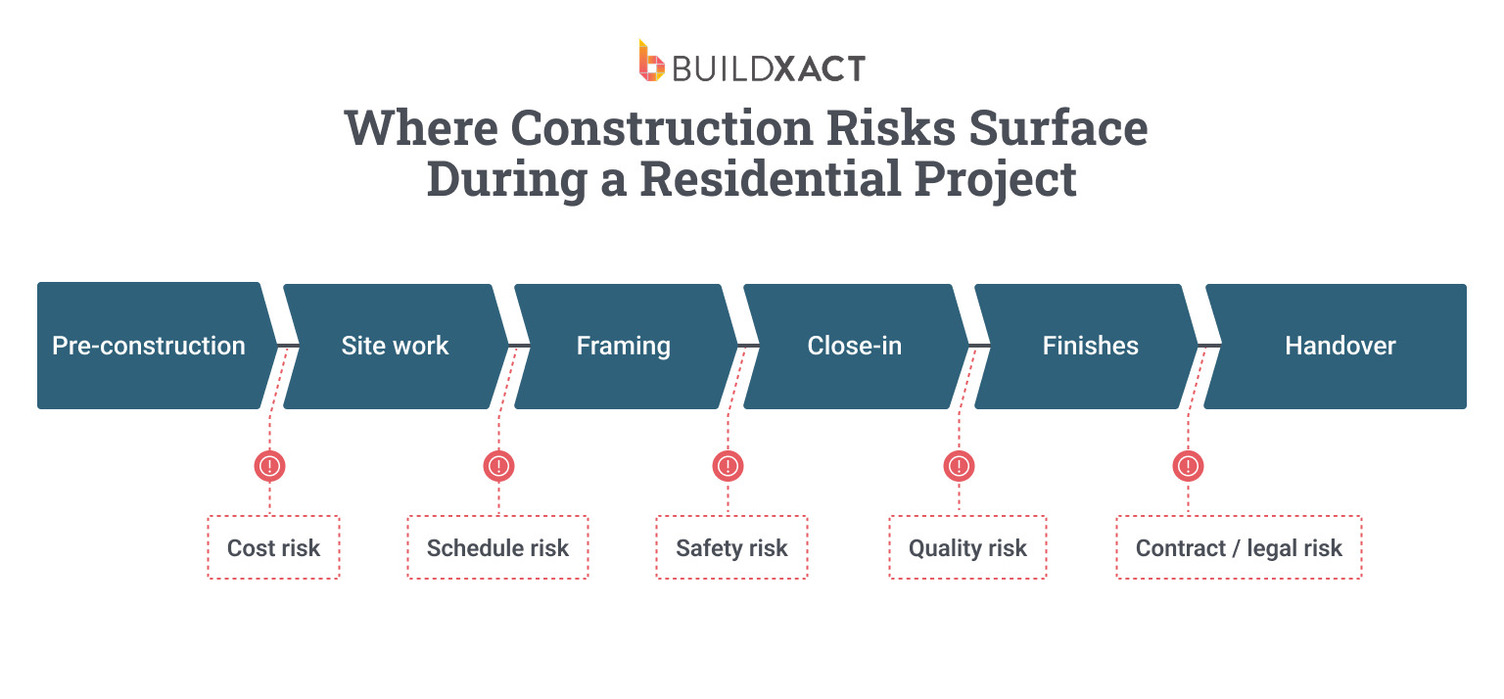

Types of Construction Risk (and Where They Show Up on Residential Jobs)

Risk doesn’t show up in one place on a residential job. It shows up in the moments where you’re trying to keep things moving: finishing an estimate under pressure, approving a change on site, or adjusting a schedule that looks fine on paper.

With ongoing pressure from labor shortages, material price swings, and financing costs, as the National Association of Home Builders reported in 2024, those decisions happen fast, and they’re exactly where risk quietly enters before it ever gets a label.

Financial (or cost) risk

Financial or cost risk usually starts quietly.

While the job is active, nothing looks broken. You pay invoices and update accounts. The issue is that most of that information only moves one way. You can see what was spent, but not when it changed or which decision introduced it.

That gap carries a real cost.

Research by Dodge Construction Network shows that coordination issues and miscommunication among trades erode roughly 10% of annual contractor profit through errors, omissions, and rework.

On residential jobs, that erosion comes from a series of reasonable decisions that never got fully tied back to the estimate that set the job in motion.

By the time the margin looks lighter than expected, you’re staring at totals instead of causes. The spend is there, but the logic behind it, the price assumption, quantity change, or informal approval has already disappeared.

Schedule risk

Schedule risk starts with assumptions that feel safe at the time. You schedule inspections based on past timelines, stack trades tightly to keep work moving, and plan around weather on paper even while parts of the site remain exposed.

While work is moving, the schedule still looks intact. The cost shows up when an inspection doesn’t clear, a delivery slips, or rain shuts work down. Crews arrive with nothing to do, resequencing begins, and carrying costs accumulate.

By the time you move the finish date, you’ve already built most downstream commitments around dates you never fully confirmed

Safety risk

Safety risk rarely comes from not knowing what to do. It comes from work moving faster than the checks meant to support it.

For example, you repeat a task enough times that it feels routine, so a shortcut feels justified because nothing has gone wrong before. Time pressure makes stopping feel harder than continuing.

At the time, the site still feels controlled. The issue only comes up when work pauses after a near-miss, an incident, or an inspection.

That pause brings claims, insurance questions, and scrutiny around what was planned versus what actually happened. In most cases, the gap appears because the plan didn’t carry forward into the sequencing and execution of the work that day.

Quality risk

Quality risk often enters when details are clarified late. A finish gets substituted without a written sign-off. A spec is interpreted differently between the office and the site, so the crew rushes to finish work near the end to hold a date that’s already been promised.

At the time, the job still looked complete. The cost shows up later in callbacks, warranty work, and quiet damage to reputation. The hardest part is explaining how the finished work drifted from what was originally priced and agreed to, when no single change was ever clearly captured.

Contract/legal risk

Contract risk builds when agreements live in conversation instead of in the job record. A client asks for a change, and you agree to keep things moving. An allowance stays vague to avoid slowing down the quote. A change order gets postponed because everyone agrees to “sort the paperwork later.”

Industry data backs up how often this turns into disputes. In its 2024 Construction Disputes Report, Arcadis found a growing decline in the quality and clarity of contracts, specifications, and designs, driven by aggressive schedules and incomplete documentation. Projects move forward faster, but the record they rely on is thinner than it should be.

On a residential job, the cost shows up when you’re invoicing or closing out, and you can’t prove what was included, what changed, or what was approved. Work goes unbilled, and charges get challenged. Write-offs follow because there’s nothing solid to point to once memories diverge.

By the time the issue surfaces, the label is familiar: contract risk. The cause usually isn’t. It’s a decision that felt reasonable in the moment and never got anchored to scope, cost, or approval, even though it still could have.

Where Construction Risk Management Breaks Down in Practice

Most residential builders don’t skip risk management entirely. They do enough of it to feel covered at the start of a job. The breakdown happens later, once the work begins moving faster than the system meant to track it can keep up.

These failures aren’t dramatic. They’re procedural. And they tend to show up in the same few ways.

Creating a list of risks and never revisiting it

You review risks early, when the job is still clean. Then create a list of risks, discuss them, and save it somewhere out of the way. As the job evolves, the work changes, but the list stays the same. By the time something actually causes a problem, the risks on paper no longer match the reality on site. When you go back to it, the list is irrelevant.

Making scope and cost decisions without documenting them

A change comes up during a walkthrough. It feels minor, so you verbally agree to keep things moving; the crew adjusts, and the job continues.

Nothing breaks in the moment. Months later, when the invoice goes out or the job is questioned, the only record of that change lives in memory. At that point, “we agreed on this” turns into “we never agreed to that,” and there’s no clear way to settle it.

No one is assigned to monitor each risk

Some risks are so obvious that everyone assumes someone else is watching them, such as pricing volatility, inspection timing, and weather exposure. Without a name attached, nothing actually gets tracked. The risk just drifts until it shows up as a cost or delay no one feels directly responsible for.

Manually tracking risks

Risk tracking often collapses under its own weight. A long register gets built to be thorough, then never updated once the job is underway. In practice, a short list that you update regularly does more than a spreadsheet no one opens. The failure is trying to manage “live” or in-progress work with tools that don’t align with how you work.

Avoiding these breakdowns is about keeping risk visible while the work is still moving, so you can resolve them right in the moment.

That’s where connected tools enable you to do this better and faster: it’s not about adding unnecessary admin or oversight, but keeping decisions, costs, and timing from drifting out of view as the job moves through phases.

Using Software to Develop a Risk Management Process for Residential Builders

Risk stays manageable when decisions stay explainable as the job moves. On residential projects, that usually breaks where information relies on memory, habit, or follow-up. Once that handoff fails, risk just stays quiet until closeout.

This is where software matters. Not as a separate risk system, but as the place where estimates, approvals, changes, and costs already live, so risk shows up while there’s still room to respond.

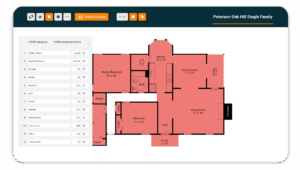

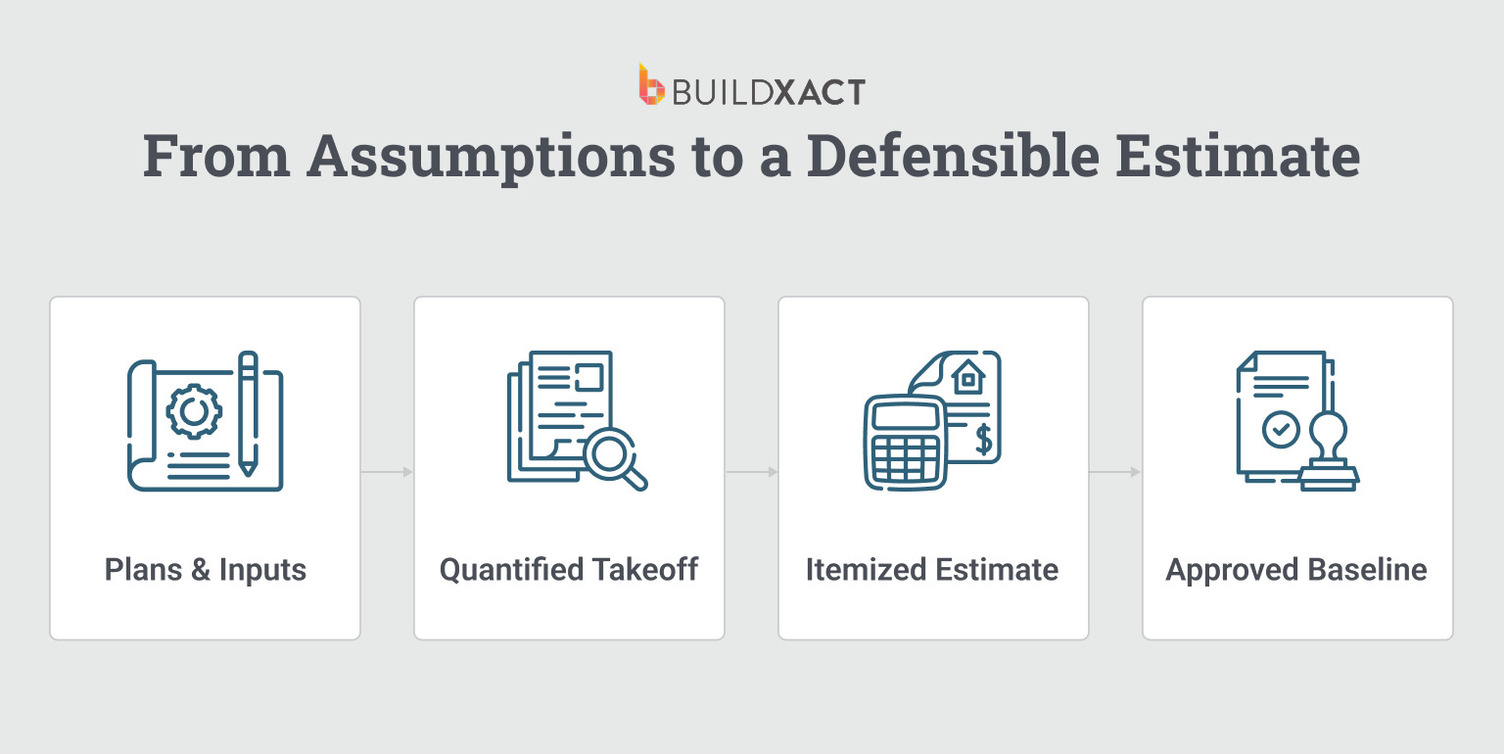

Establish assumptions you can track back to the source, right at the estimate stage

Most risk occurs before the estimate goes out, when scope lives in your head rather than on the page. You build from memory, reuse old line items, and rely on tired eyes to catch gaps. The number looks right, but the logic behind it never gets written down. That logic matters later, when the job no longer matches the mental picture you priced against.

AI assistance, using features like Blu from BuildXact, pulls those assumptions into view and gives you options for addressing, fixing, changing, and making smarter, more proactive decisions.

So, instead of starting from a blank screen, you react to a complete scope. Reviews flag missing or zero-priced items before the quote goes out. Quantities stay tied to plans and system logic.

The estimate becomes a reference point because it’s explicit. When something changes mid-job, you’re measuring against a known starting truth instead of reconstructing intent after the fact.

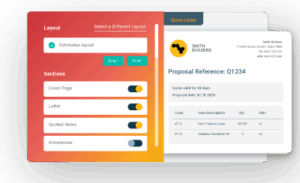

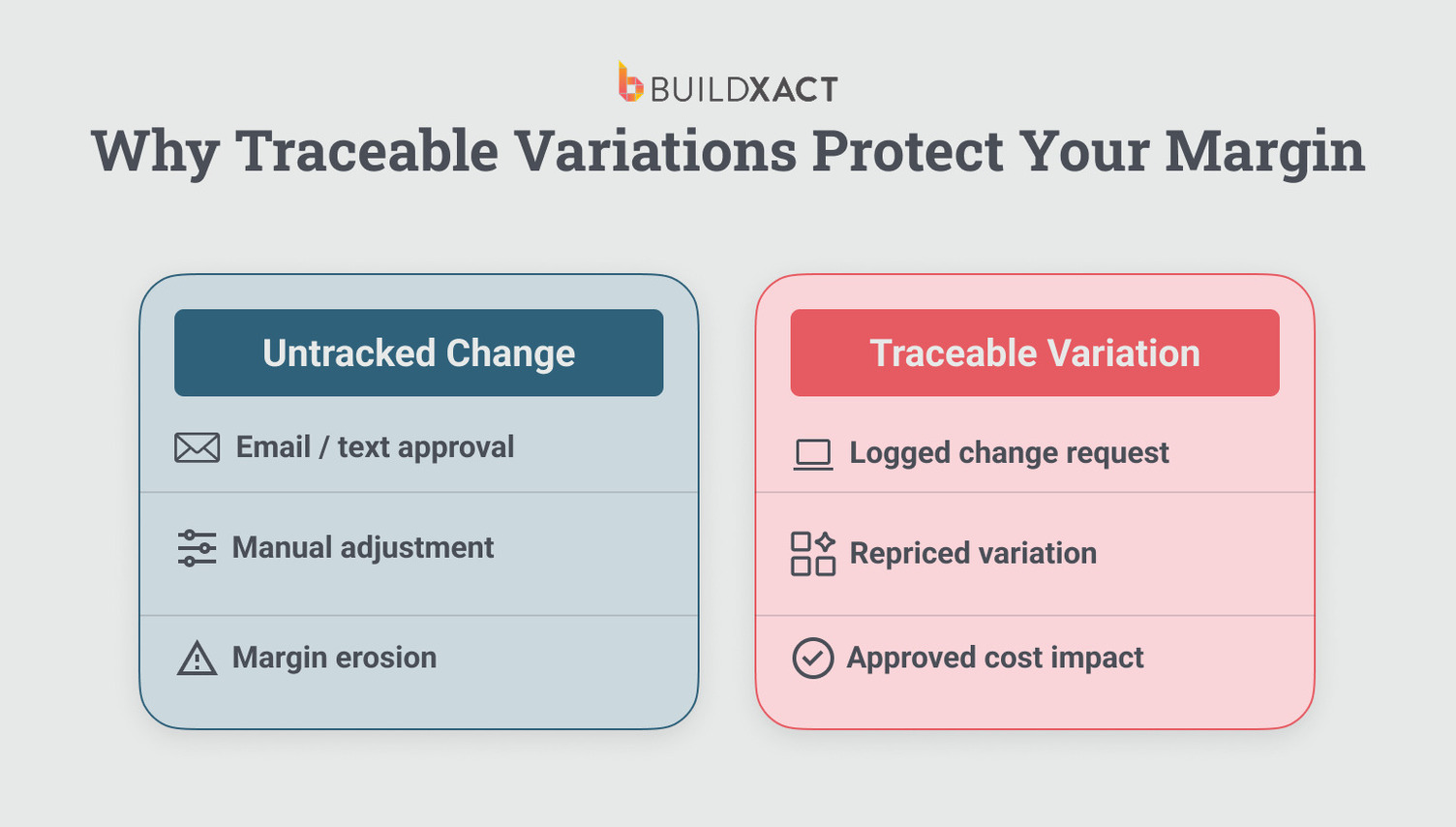

Lock in decisions using centralized approval trails visible to all

Most disputes start with an agreement that never landed on solid ground: A change gets approved during a walkthrough, the crew moves forward, and the record never catches up. Everyone remembers the conversation until it becomes clear that their memories are just bit different.

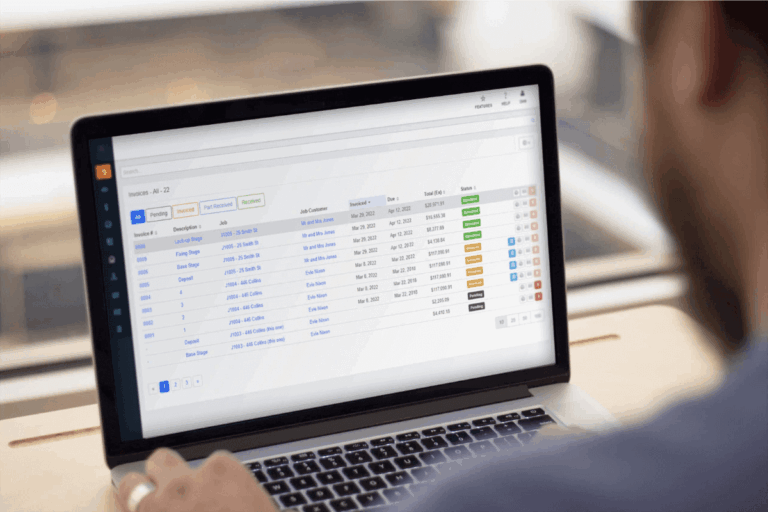

But when approvals live alongside scope and cost, decisions stop drifting. In Buildxact, approvals sit directly against estimates and variations, with before-and-after costs recorded automatically.

That type of connection between important information matters: it removes the “risk” of interpretation from the equation. Instead of debating intent later, you can point to what changed, when it was approved, and how it affected the numbers.

Track scope and cost changes as controlled variations

Margin erosion usually comes from small changes layered over time. An upgrade here, a quantity shift there, a price move between estimate and order. The job keeps moving, but the estimate stays frozen. Each individual change feels absorbable, but the total never does.

Change orders act as control points that trace back to the original estimate logic, so scope and cost move together. With real-time pricing and estimate-driven schedules, price movements stop being a silent trigger.

Approved changes update job costs and timing immediately, keeping the record current as the work progresses. The job doesn’t slow down. The feedback loop tightens.

Maintain continuous estimate-to-actual visibility

Overruns don’t arrive all at once. They accumulate while everything still looks fine. A phase runs long to protect the schedule. Material usage creeps. A price increase gets normalized because nothing else appears broken.

When job costs stay tied to the original estimate structure, deviations show up early. You can see where usage drifts from what was priced while decisions are still adjustable. Visibility doesn’t force action; it gives you the option to act. Cost tracking stops being a closeout explanation and becomes a signal while the job is still underway.

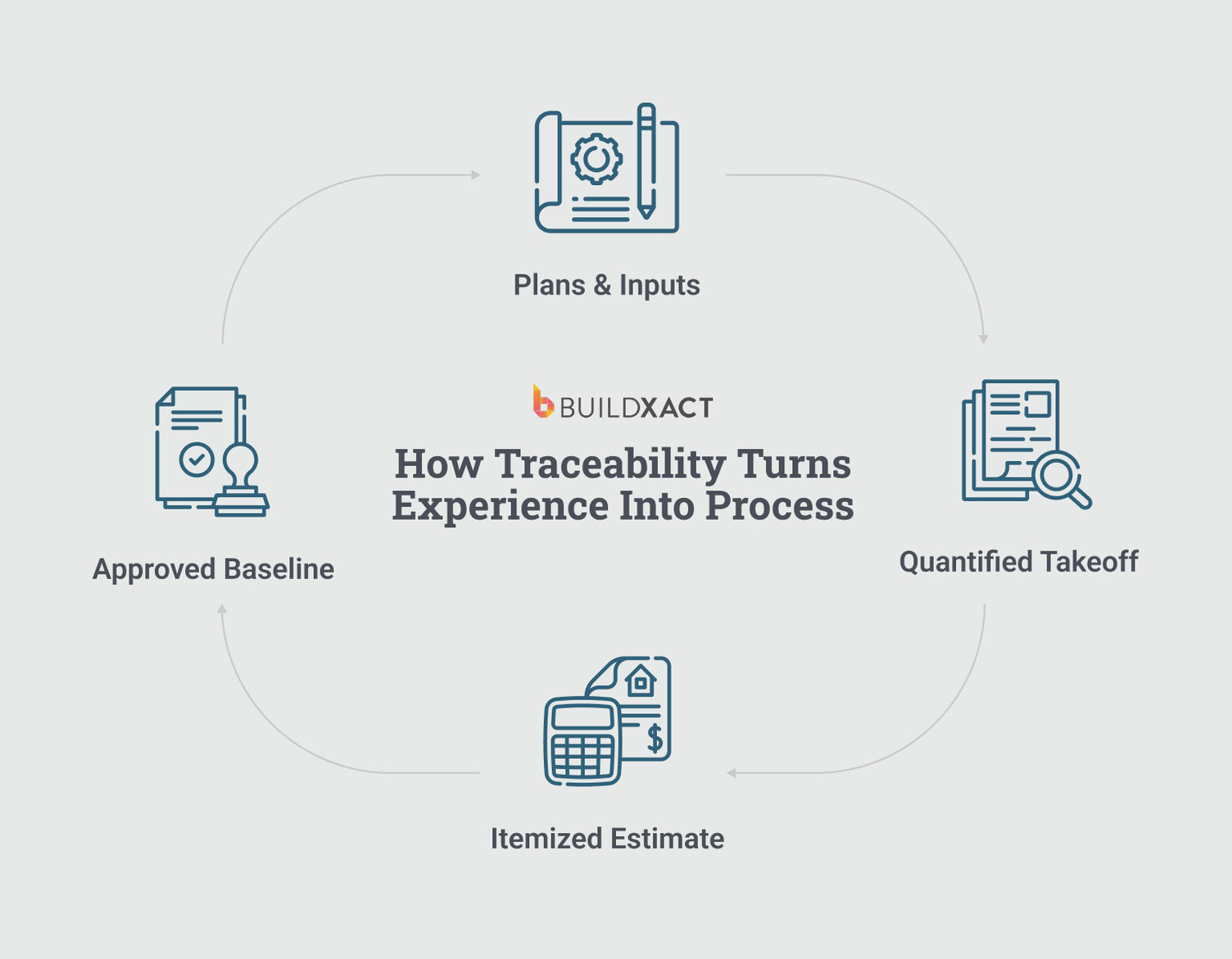

Turn job history into transferable risk intelligence

Experience only reduces risk when it carries forward. Otherwise, each job resets the same way the last one did. Builders remember where things went wrong, but memory doesn’t change the next estimate.

When outcomes tie back to estimates, variations, and actual costs, past jobs stop living in someone’s head. They shape the next bid automatically. Templates, assemblies, and pricing logic evolve based on real results.

That’s how improvement compounds without adding oversight. Scale stops increasing risk because the system, not the individual, carries the learning forward.

Keeping Jobs Moving Without Losing Control of Risk

Construction risk management doesn’t fail because builders can’t predict what will go wrong. It fails because decisions get made faster than they get carried forward. By the time costs settle, schedules slip, or disputes surface, the moment to act has already passed.

The framework is familiar. What matters is whether it fits the way small residential teams actually work. When estimates, changes, schedules, and costs stay connected, risk becomes visible while decisions are still reversible.

If you want to see how risk decisions can live inside your estimates, schedules, and budgets — while the job is still moving — start with Buildxact for free or book a demo today.